PIX coordinates built-to-suit developments to create space solutions for our corporate clients, uniting the efforts of landowners, developers, and investors, to our knowledge, capabilities, and information.

We execute and control the project for its investors through the assembly and supervision of technical teams, project management, financial monitoring, and future operation through its property management company OPERA.

Real Estate Investment Management and Property Management

Real Estate Investment Management and Property Management

PIX integrally manages the real estate investments of our clients. The international experience of our team in the structuring, development, marketing and operation of real estate is our main strength. PIX looks after the owner´s interests, managing the investment, and preserving/increasing the assets value through professional real estate management.

Our management also benefits tenants by improving the positioning and image of the property, sales prospects, and identifying operational savings.

We develop a structured strategic plan for each investment in three areas: control and monitoring of the investment, evaluation, and implementation of opportunities to increase asset´s value, and capital optimization.

Real Estate Investment Fund for Development

Real Estate Investment Fund for Development

Through its co-investment real estate fund, PIX manages private investors’ resources to develop built-to-suit projects tailored to the needs of its clients, offering long-term leases for corporate users, logistics centers, and shopping centers.

PIX operates the assets through its operating platform OPERA, ensuring its maintenance and long-term improvement.

PIX represents a real estate financing solution for the user of large spaces. Tenants may invest their resources in its operation and growth and separate the risks and burdens of real estate from its balance sheets. Our investors in the fund obtain a professional solution for their long-term investments, with ample access to information for decision-making, unique and well-structured opportunities, and an excellent capacity for investment management and administration that preserves the investment and creates value over time.

Project development

Project development

The development of a real estate project starts from identifying a market need, or as a strategy to maximize the use and value of a real estate asset.

PIX identifies real estate development opportunities and conceptualizes the appropriate product for the market based on its knowledge, research, and information.

Our professionals with vast experience in financial structuring and real estate project management, direct the team of specialists necessary developing master plans, building permits, technical coordination, and financial monitoring of projects.

Through Opera, a subsidiary company of PIX for the development and operation of real estate assets, we property and asset manage our leased projects.

Investment sales

Investment sales

PIX is a leader in the real estate market in Colombia to structure investment sales. PIX carefully analyzes the asset and the client’s requirements, to structure a custom-made competitive investment sales process to maximize the client´s value.

The process of Investment Sales is structured with clear and transparent rules, complete information supported in secure data rooms, and predefined closing dates.

Case Studies

Bazaar@ / Development, Leasing, Project Mngt, Prop Mngt

Customer Requirements and Challenges

Leveraged on PIX´ commercial activity in the retail market for owners and tenants, PIX identified an opportunity to develop Convenience Shopping Centers, which provided street merchants a real estate solution with parking, security, operation and marketing. PIX acquired an initial land for an investor in Bogotá, on which it developed the first Bazaar® concept. In order to ensure the growth of the operation, PIX managed to bring an institutional investment group from the Colombian insurance sector, to found Opera, a real estate company specialized in the development, commercialization, and operation of said centres.

Actions

As of December 2017, Opera had developed three Bazaar centers, and was working on the initiation of a fourth commercial center opening in 2019. The operating company structures, manages, commercializes, and operates the centers under the concession scheme, for different investment groups and land owners with whom it is associated. PIX has participated with Opera in the identification of opportunities, financial structuring, and the sale of one of these centers to a pension fund, keeping its long-term operation.

Results

PIX and Opera have managed to create a novel concept, with great acceptance by merchants, the community and investors, achieving occupations above 97%. Bazaar is today a benchmark in the category of convenience centers, has a professional operation, and a great potential for growth.

Midpoint 19 / 5,500 m2 / Redevelopment, Leasing, Project Mngt

Meridiano 19

Midpoint 19 consists of the acquisition of an abandoned industrial facility of 5,500 m2 and its conversion to a state-of-the-art office building. As the name of the project suggests, the building is located at the midpoint of Bogotá, near the main roads and public transportation lines, the city center, government entities, and universities. The location is also considered Up-and-Coming on Calle 19 with Carrera 33 with a major urban renovation undergoing.

Actions

PIX identified the asset as a potential high yield investment opportunity. Through his private investment fund, PIX developed the technical and architectural studies for its rehabilitation. Once the technical, financial and legal feasibility was achieved, it structured the vehicle for the acquisition and development of the project, attracting private capital. PIX represented the investment group in the acquisition of the property, aligned the interests of the investor group with the builder, and developed the first LEED Gold certified conversion project in Colombia. The reconstruction involved the structural reinforcement of the building to comply with the Seismic code, the modernization of the façade, the total replacement of the technical installations and equipment, vertical transportation, and installation of the fire protection system. The building was LEED Gold certified by the USGBC.

Results

PIX actively sought the ideal tenant from the beginning of the remodeling following a direct and personalized market strategy. The strategy led to a fully-furnished-office lease contract signed with a government entity once the renovation was completed.

Industrial zone building / 6.000 m2 /Redevelopment, Investment Sale

Customer Requirements and Challenges

The Owner of the property, a Colombian leader in the manufacture of corporate furniture, hired PIX to sell one of its industrial plants located in the Americas industrial zone, between Avenida de las Americas and Calle 13, in the vicinity of the public transportation system, Transmilenio. PIX analyzed the location and the property in detail, and identified a remodeling potential to double the usable area, and reconvert the warehouse to office use, significantly increasing the value of the asset for the owner.

Actions

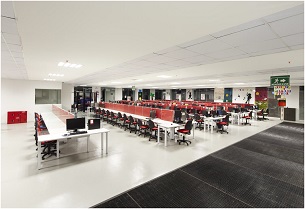

In conjunction with the owner, PIX initiated architectural designs based on the construction of a mezzanine level to increase the leaseable area and attract a larger tenant. PIX signed a five-year pre-lease contract with an international BPO that activated the start of the renovations. The works included the construction of 2,500 m2 of the new mezzanine, the construction of evacuation routes, the replacement of the roof, the interior adjustments, installation of equipment and new fire detection and extinguishing systems.

Results

PIX secured a pre-lease contract, to develop the building according to the needs of a client. The remodeling was completed in five months. Six months after the occupation, PIX sold the asset to an institutional investor through a competitive investment sale process.

Consultoría Digital

Consultoría Digital